Travelers Insurance is pleading in a Declaratory Judgment Complaint that it should not have to cover litigation costs or pay damages because Safelite knowingly lied about repairing cracked windshields. In the underlying case captioned "Richard Campfield et al. v. Safelite Group, In et al." docket number 2:15-cv-02733. filed in the United States District Court Southern District of Ohio Eastern Division is a simple case - Safelite lied to insurance companies, insureds and to consumers about windshield crack repair length because they made far more profit on the more expensive windshield replacement. Safelite in the litigation could not produce any evidence to support the nonsensical 6-inch limitation.

Travelers and Discover have Commercial General Liability Policies with Safelite.

Ultra Bond, a windshield crack repair kit manufacturer and it's owner Richard Campfield sued Safelite for falsely advertising that cracks in windshields cannot be repaired if they are" longer than a dollar bill" or six-inches which is false.

The Campfield case was filed in August 2015. After four years of discovery and over 30 depositions Ultra Bond filed for Summary Judgement and for an Immediate Injunction in September 2019 with the last reply filed in December 2019. This is a cut and dry case and windshields are the number one auto insurance claim in the United States, so it affects millions of consumers safety and finances and three industries. It has been waiting for a ruling from Judge Micheal H. Watson since December 2019.

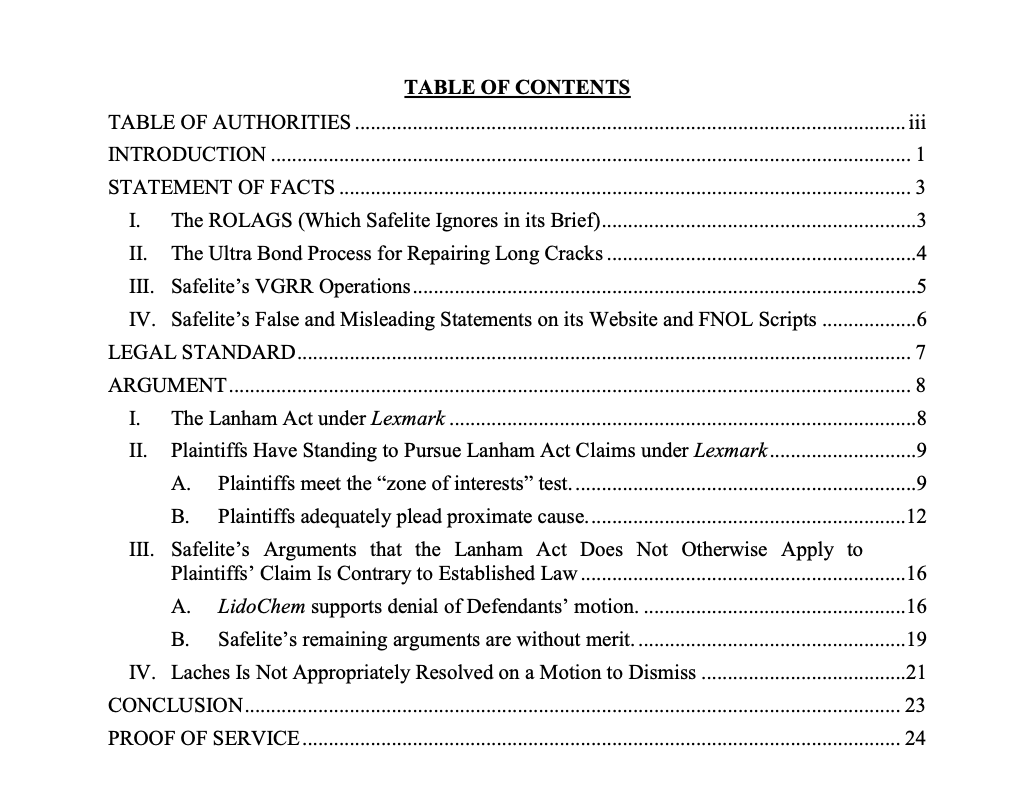

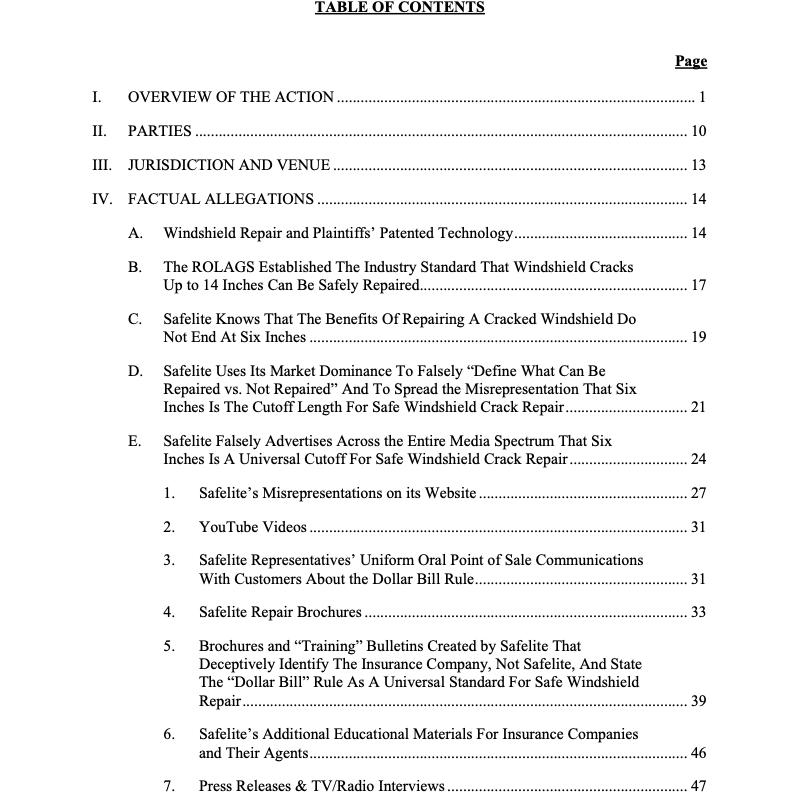

The auto glass industry's American National Standard Institute (ANSI) standard for windshield repair called the Repair of Laminated Auto Glass Standard (ROLAGS) for long cracks is 14-inches long, not 6-inches. Over 90% of cracked windshields are over 6-inches due to manufacturing defects and stresses in the windshield. Expert damage reports in the case conclude that Safelite has deceived millions of consumers out of billions of dollars since the Windshield Repair Standard was approved in 2007.

Safelite was on the ROLAGS committee that developed the standard and voted in favor of it with the 14-inch crack length but after it was approved by ANSI Safelite did the math and could see that telling consumers and insurers the truth would cost them hundreds of millions dollars.So they decide to lie to insurance companies and to consumers about the safety and efficacy of repairing long cracks.

Evidence found in Safelite's internal documents and emails during discovery found that Safelite KNEW repairing cracks was SAFER than replacing the windshield and repairing cracks up to 24-inches long is safe and viable.

Travelers has plead in their pleadings that although the policy covers Advertising Injury; the policy states under Section 2:

Exclusions

The insurance does not apply to:

a. Knowing Violation of Rights of Another

"personal and advertising injury" caused by or at the direction of the insured with the knowledge that the act would violate the rights of another and would inflict "personal and advertising injury."

b. Materials Published With Knowledge Of Falsity

"Personal and advertising injury" arising out of oral or written publication of material, if done by or at the direction of the insured with knowledge of its falsity . . .

Click here to read the entire Travelers Complaint.

Click here to read the entire Ultra Bond Motion for Summary Judgment.

Ohio law puts a heavy burden on insurance providers when it comes to defeating coverage. "To defeat coverage, the insurer must establish not merely that the policy is capable of the construction it favors, but rather that such an interpretation is the only one that can fairly be placed on the language in question. Further, "provisions in an insurance contract that are reasonably susceptible of more than one interpretation will be construed liberally in favor the insured." And, "ambiguities in insurance policies should be construed liberally in favor of coverage."

Travelers has not established its interpretation is the only fair interpretation under its policy. There is no language in the policy which requires the claim to allege the common low elements of disparagement for coverage. Travelers' interpretation is inconsistent with the ordinary meaning of the word disparage. Further, the Federal Litigation's amended complaint alleges Safelite made false statements which harmed Ultra Bond's business. Thus, the Court is unconvinced "disparages" as used in the policies, exclusively means a common law claim for disparagement that properly alleges all the elements of disparagement.

Based on the above, the Court finds Travelers does have a duty to defend Safelite in the Federal Litigation, because the Federal Ligation claim is for an advertising injury.

Safelite field a counter claim for Breach of Contract which is still pending. Once the counter claim is over Travelers plans to appeal.

Travelers has filed a motion to intervene in the Ultra Bond vs Safelite federal case.